jersey city property tax delay

The District Court with headquarters located in Annapolis is a statewide court with 33 locations in 12 districts. 3550-84 based on weight and age of vehicle.

Property Taxes By State Embrace Higher Property Taxes

Section 544-63 - Definitions relative to tenants property tax rebates.

. Low-income households can also get a freeze or reduction in property taxes. Section 544-64 - Property tax rebate to tenants by owner of qualified real rental property. If you are over the age of 65 the first 75000 of your homes property value is exempt.

NJ Department of Health. City officials said thered be a delay because supply chain issues were preventing a vendor from procuring enough envelopes to complete the mailing. The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac.

Section 544-65 - Computation of amount of property tax reduction. All 50 states provide some kind of tax relief for senior. An ordinance of the city of jersey city in the county of hudson state of new jersey authorizing the transfer of certain city-owned real property identified on the tax map of the city of jersey city as block 2190101 lots 1 4 6 8 and 9 and block 21901 lot 4 to the jersey city redevelopment agency.

Some states require you to pay an annual tax on the value of your vehicle. You may be eligible if you have a limited income and you are at or above a certain age - People with. FREE detailed reports on 149 Landlord Tenant Attorneys in Prince Georges County MarylandFind 267 reviews disciplinary sanctions and peer endorsements.

The Chief Judge judges and staff ensure its mission -. To help finance the mall which features an indoor ski slope amusement park water park and ice skating rink New Jersey in 2016 approved a package of 11 billion of tax-exempt municipal bonds. Well review the vehicle property tax for each state in the table below.

Below we list the state tax rate although your city or county government may add its own sales tax as well. For those who qualify tax exemptions generally come in four different categories. The Office of Property Assessment posted the new values online in May but it was unclear exactly when homeowners some without a personal computer or internet access would receive the official notice in the mail.

Property Tax Exemptions for Senior Citizens in Different States. As a Michigan native Dr. Office of Vital Statistics Registry.

Paramus p ə ˈ r æ m ə s pə-RAM-əs is a borough in Bergen County New Jersey United StatesA bedroom community of New York City Paramus is located 15 to 20 miles 24 to 32 km northwest of Midtown Manhattan and approximately 8 miles 13 km west of Upper ManhattanThe Wall Street Journal characterized Paramus as quintessentially suburban. Please visit the New Jersey Vital Statistics website for the most up to date information regarding ordering options and information or call toll-free at 1-866-649-8726. Your state pays your taxes and charges you interest.

Freehold Township is a township in Monmouth County New Jersey United StatesThe township is both a regional commercial hub for Central New Jersey home to the Freehold Raceway and Freehold Raceway Mall and a bedroom community of New York City located within the Raritan Valley region of the much larger New York Metropolitan Area. The Panvel Municipal Corporation has managed to collect only around Rs 170 crore as property tax against the proposed target of Rs 1000 crore since October 1 2016 as a majority of the residents. Kella attended University of Michigan Go Blue with the initial intent.

As a wholesale company conducting business in the state of Texas you are required to have a sales tax certificate when purchasing items at wholesale prices Therefore suppliers must request a copy of your resale certificate before selling you items at wholesale. Baltimore city landlordtenant court. Earned income tax.

The township is located roughly. If the land is leased the owner can use the amount produced and marketed by the lessee to attain agricultural designation. Section 544-67 - Payment of property tax rebate credit.

The personal residence exemption which excludes a portion of the gain from the sale of a primary residence is 500000 for married couples compared with 250000 for single homeowners. If you own a home with your spouse you may be able to pocket more of the proceeds from the sale of your property up to twice as much. This product so long as its amount is documented can be consumed by people or livestock on the property rather than being sold to an outside consumer.

This state has property tax relief programs geared towards retirees that allow you to delay property tax payments until your house is sold. Why do I need a Sales Tax Certificate to purchase wholesale items for Resale in the State of Texas. Mortgage rates close in on 6 highest since 2008.

Produce and market 1500 of agricultural product on the property. Section 544-66 - Computation of property tax rebate. Typically the program operates as a loan with interest.

A property tax deferral program allows you to delay your property tax payments. Property Tax Deferral for Seniors.

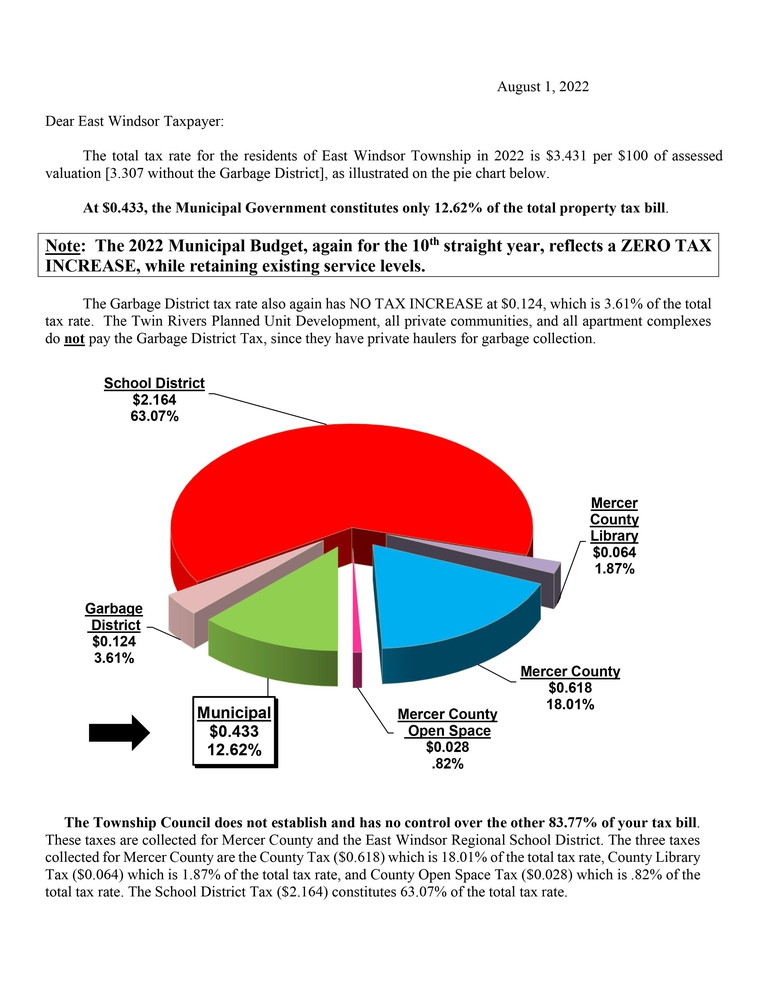

Official Website Of East Windsor Township New Jersey Tax Collector

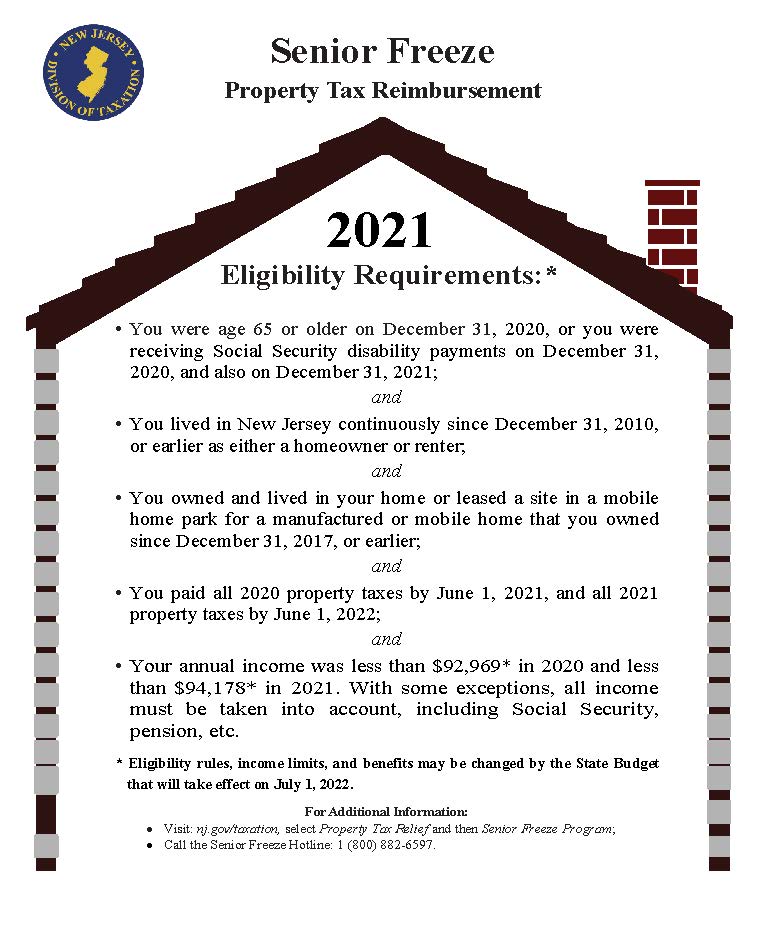

Nj Property Tax Relief Program Updates Access Wealth

New York Property Tax Calculator 2020 Empire Center For Public Policy

Here S How Nj Property Taxes Are Trending Nj Spotlight News

The Official Website Of The Borough Of Roselle Nj Tax Collector

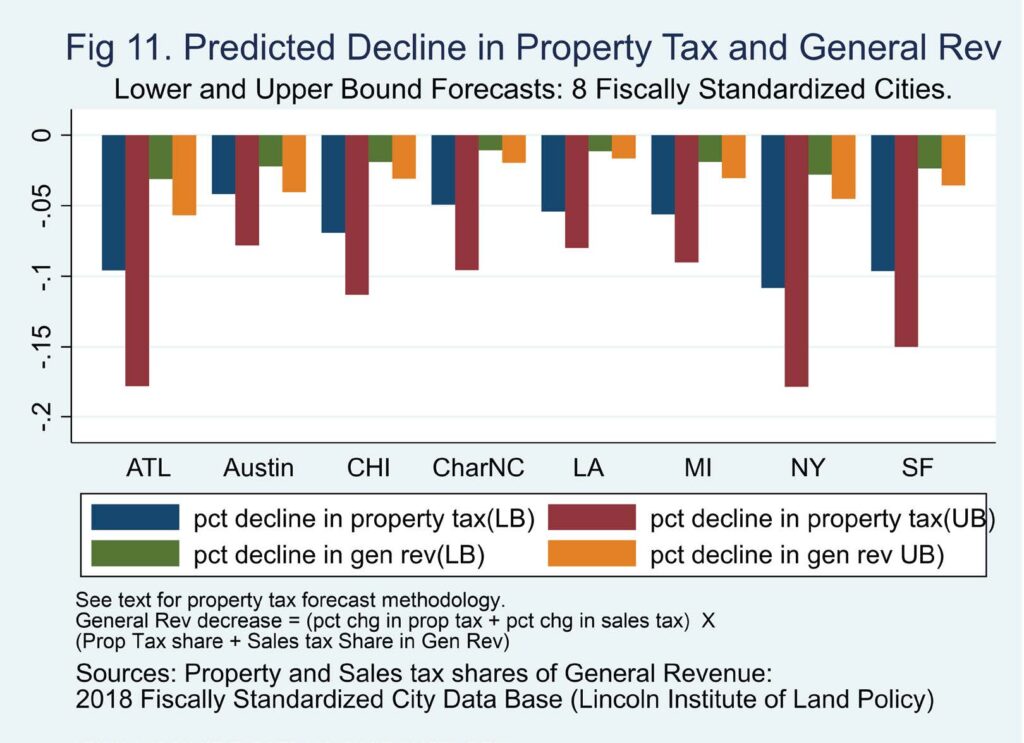

The Impact Of Work From Home On Commercial Property Values And The Property Tax In U S Cities Itep

Property Taxes Highlands County Tax Collector

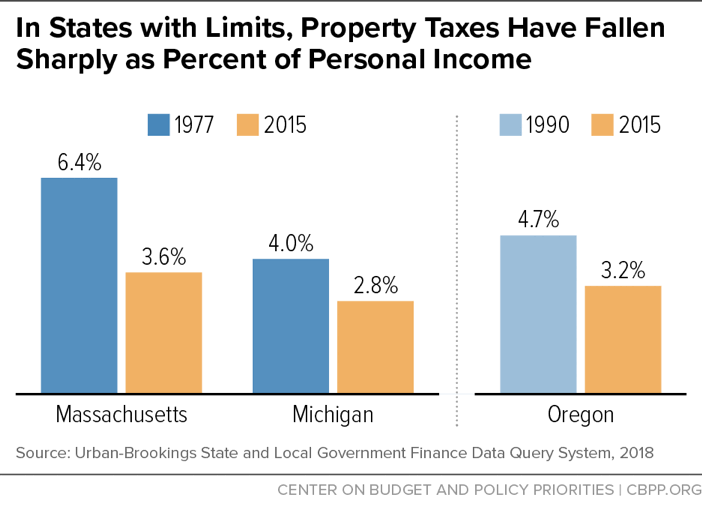

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

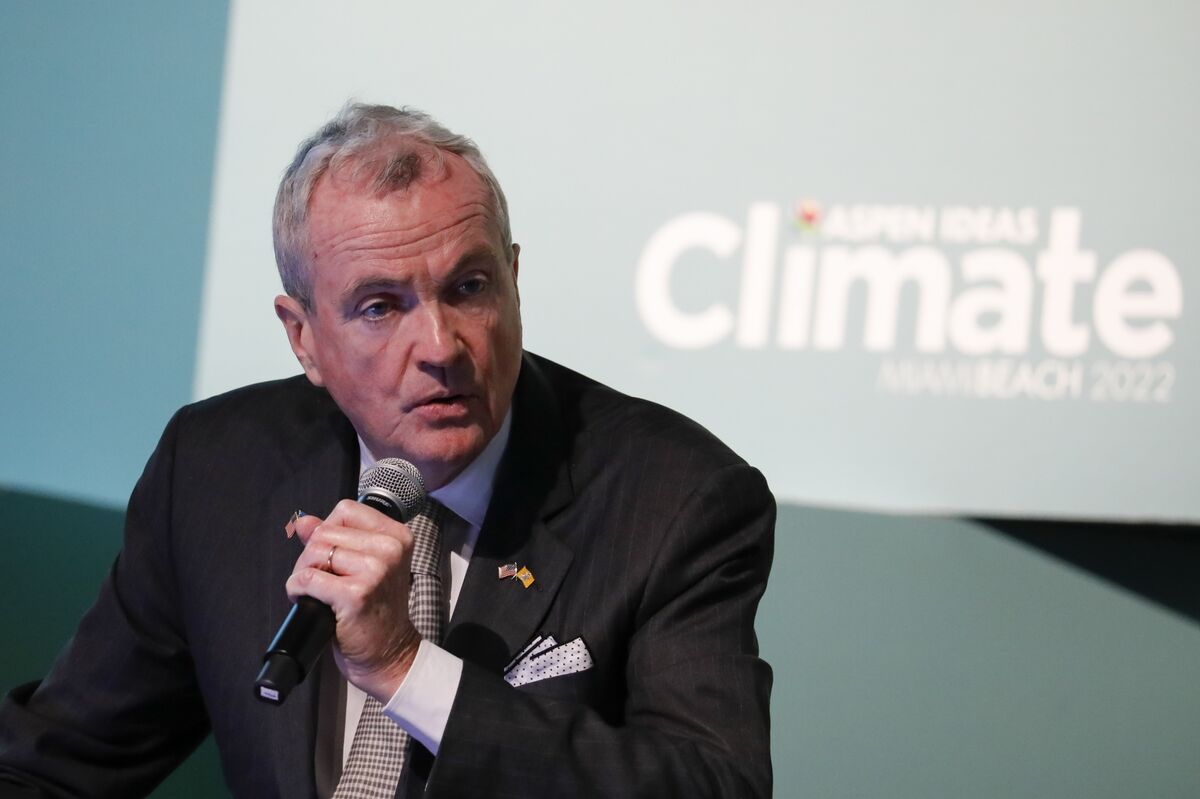

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Tamil Nadu Property Tax Hike 25 50 Hike Covers About 83 Of Houses The Hindu

Tax Assessor Township Of Franklin Nj

The Official Website Of City Of Union City Nj Tax Department

N J Now Has 2b In Property Tax Relief What You Need To Know And How To Get Your Rebates Nj Com